用python炒股

发布时间:2019-09-25 08:26:07编辑:auto阅读(2608)

- 1、市场----买卖什么

- 2、头寸规模----买卖多少

- 3、入市----何时买入

- 4、止损----何时退出亏损的头寸

- 5、止盈----何时退出盈利的头寸

- 6、离市----何时离市

- 买卖A股

- 全仓

- 当日涨幅超过3%买入。

- 当持有头寸亏损超过3%,平仓

- 当日跌幅大于3%或者三个连续阴线

前言

由于笔者并无深厚的数学功底也无深厚的金融知识, 所以不会在本文中引用各种高深的投资模型或数学模型,参考书籍主要是《海龟交易法则》《以交易为生》。

交易系统

在交易之前,我们应该首先有一个交易系统用于指导我们自己交易,不一定有什么规范,但是可以作为一个交易的依据,至于这个依据可不可行,科不科学那就见仁见智了。

当然了,这里的交易系统不一定是程序,只是指你自己的交易原则或者遵守的一些技巧或者方法,你可以手动执行也可以借助编程语言,编程语言不就是一套用来使用的工具么.

这里参考海龟交易法则里面的交易体系(这里只是参考大方向).

建立一个完善的交易体系,我们至少应该思考一下六个方面。

简单的示例

分析: 这个交易策略其实只有在行情以波浪形状向上的行情时候才能获利,如果是盘整的情况下,怕是会亏的很惨。这里之所以写的这么简单粗暴是为了后面策略测试撸代码简单。

数据获取及处理

因为这里说的是用python炒股,所以应该采用程序的方式去获取数据,如果人工炒股,下载任何股票行情软件都是可以的,但是人工的执行是需要花费比较多的精力的。

而python语言中用于获取股票行情数据的库,最有名莫过于tushare了。

这里以上证乐视的股票为例吧。

python环境安装

安装Anaconda(python2版本)下载地址:https://www.anaconda.com/download/

注:如果没安装过这个环境的经验,就百度或者谷歌一下吧,如果不是安装anaconda则需要艰难的自行解决依赖。

安装tushare

pip install tushare获取行情数据

import pandas as pd

import tushare as ts

# 通过股票代码获取股票数据,这里没有指定开始及结束日期

df = ts.get_k_data("300104")

# 查看前十条数据

df.head()

# 查看后十条数据

df.tail()

# 将数据的index转换成date字段对应的日期

df.index = pd.to_datetime(df.date)

# 将多余的date字段删除

df.drop("date", inplace=True, axis=1)注:关于股票数据的相关处理需要由pandas,matplotlib的知识,参考:http://pandas.pydata.org/pandas-docs/version/0.20/10min.html

计算常用指标

# 计算5,15,50日的移动平均线, MA5, MA15, MA50

days = [5, 15, 50]

for ma in days:

column_name = "MA{}".format(ma)

df[column_name] = pd.rolling_mean(df.close, ma)

# 计算浮动比例

df["pchange"] = df.close.pct_change()

# 计算浮动点数

df["change"] = df.close.diff()最终处理完成后的结果如下:

df.head()

Out[13]:

open close high low volume code MA5 MA15 MA50 \

date

2013-11-29 9.396 9.741 9.870 9.389 146587.0 300104 NaN NaN NaN

2013-12-02 9.298 8.768 9.344 8.768 177127.0 300104 NaN NaN NaN

2013-12-03 8.142 8.414 8.546 7.890 176305.0 300104 NaN NaN NaN

2013-12-04 8.391 8.072 8.607 8.053 120115.0 300104 NaN NaN NaN

2013-12-05 7.983 7.366 8.108 7.280 253764.0 300104 8.4722 NaN NaN

pchange change

date

2013-11-29 NaN NaN

2013-12-02 -0.099887 -0.973

2013-12-03 -0.040374 -0.354

2013-12-04 -0.040647 -0.342 可视化

走势图

所谓一图胜前言,将数据可视化可以非常直观的感受到股票的走势。

个人觉得,如果用程序炒股还是应该一切都量化的,不应该有过多的主观观点,如果过于依赖直觉或者当时心情,那么实在没必要用程序分析了。

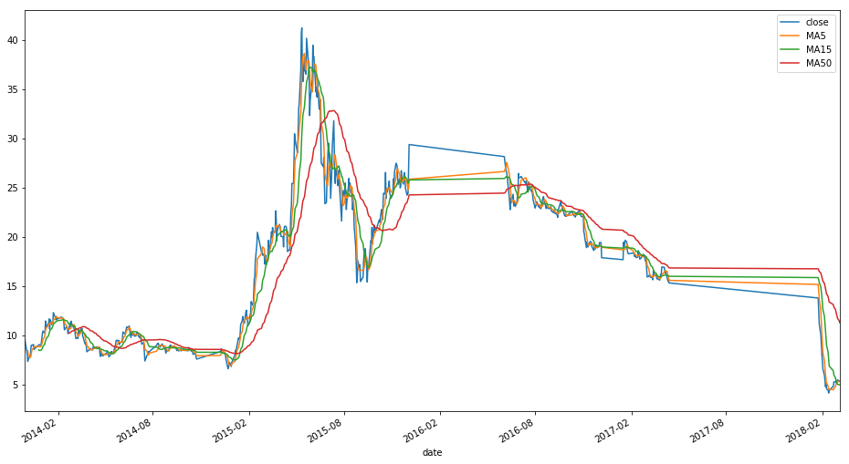

df[["close", "MA5", "MA15", "MA50"]].plot(figsiz=(10,18))效果如下:

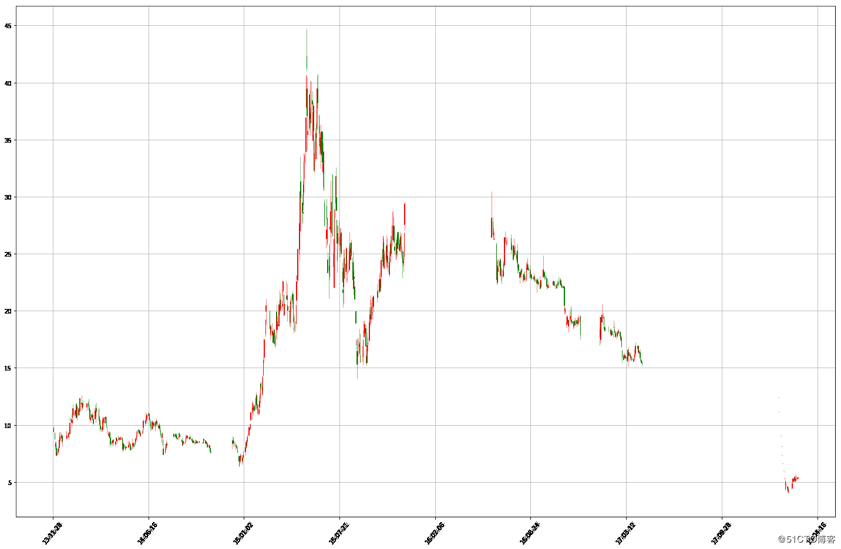

k线图

import matplotplib.pyplot as plt

from matplotlib.daet import DateFormatter

from matplotlib.finance import date2num, candlestick_ohlc

def candlePlot(data, title=""):

data["date"] = [date2num(pd.to_datetime(x)) for x in data.index]

dataList = [tuple(x) for x in data[

["date", "open", "high", "low", "close"]].values]

ax = plt.subplot()

ax.set_title(title)

ax.xaxis.set_major_formatter(DateFormatter("%y-%m-%d"))

candlestick_ohlc(ax, dataList, width=0.7, colorup="r", colordown="g")

plt.setp(plt.gca().get_xticklabels(), rotation=50,

horizontalalignment="center")

fig = plt.gcf()

fig.set_size_inches(20, 15)

plt.grid(True)

candlePlot(df)效果如下:

注: 这里只是一个示例,说明matplotlib的强大以及小小的演示,如果遇到什么奇怪的问题就查api或者google吧。

策略测试

手动撸代码

这里用最近买过的一只股票吧,京东方A(000725)。

# 导入相关模块

import tushare as ts

import pandas as pd

# 获取数据

df = ts.get_k_data("000725")

# 处理数据

df.index = pd.to_datetime(df.date)

df.drop("date", axis=1, inplace=True)

# 计算浮动比例

df["pchange"] = df.close.pct_change()

# 计算浮动点数

df["change"] = df.close.diff()

# 查看当前数据数据前五行

open close high low volume code pchange change

date

2015-07-20 4.264 4.234 4.342 4.165 13036186.0 000725 NaN NaN

2015-07-21 4.136 4.195 4.274 4.096 8776773.0 000725 -0.009211 -0.039

2015-07-22 4.175 4.146 4.214 4.067 9083703.0 000725 -0.011681 -0.049

2015-07-23 4.136 4.254 4.283 4.096 12792734.0 000725 0.026049 0.108

2015-07-24 4.224 4.136 4.254 4.106 13009620.0 000725 -0.027739 -0.118

# 设定回撤值

withdraw = 0.03

# 设定突破值

breakthrough = 0.03

# 设定账户资金

account = 10000

# 持有仓位手数

position = 0

def buy(bar):

global account, position

print("{}: buy {}".format(bar.date, bar.close))

# 一手价格

one = bar.close * 100

position = account // one

account = account - (position * one)

def sell(bar):

global account, position

# 一手价格

print("{}: sell {}".format(bar.date, bar.close))

one = bar.close * 100

account += position * one

position = 0

print("开始时间投资时间: ", df.iloc[0].date)

for date in df.index:

bar = df.loc[date]

if bar.pchange and bar.pchange > breakthrough and position == 0:

buy(bar)

elif bar.pchange and bar.pchange < withdraw and position > 0:

sell(bar)

print("最终可有现金: ", account)

print("最终持有市值: ", position * df.iloc[-1].close * 100)输出如下:

开始时间投资时间: 2015-07-20

2015-07-29: buy 3.83

2015-07-30: sell 3.653

2015-08-04: buy 3.752

......

2018-02-27: sell 5.71

2018-03-06: buy 5.79

最终可有现金: 333.3

最终持有市值: 7527.0结论: 通过上面的测试发现资亏了两千多...

借助测试框架

借助测试框架才是正确的回撤姿势,因为框架包含了更多的功能。这里使用pyalgotrade。

简单使用

from pyalgotrade import strategy

from pyalgotrade import technical

from pyalgotrade.barfeed import yahoofeed

# 自定义事件窗口类

class DiffEventWindow(technical.EventWindow):

def __init__(self, period):

assert(period > 0)

super(DiffEventWindow, self).__init__(period)

self.__value = None

def onNewValue(self, dateTime, value):

super(DiffEventWindow, self).onNewValue(dateTime, value)

if self.windowFull():

lastValue = self.getValues()[0]

nowValue = self.getValues()[1]

self.__value = (nowValue - lastValue) / lastValue

def getValue(self):

return self.__value

# 自定义指标

class Diff(technical.EventBasedFilter):

def __init__(self, dataSeries, period, maxLen=None):

super(Diff, self).__init__(dataSeries, DiffEventWindow(period), maxLen)

# 定义自己的策略

class MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, diffPeriod=2):

# 传入feed及初始账户资金

super(MyStrategy, self).__init__(feed, 10000)

self.__instrument = instrument

self.__position = None

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__diff = Diff(self.__prices, diffPeriod)

self.__break = 0.03

self.__withdown = -0.03

def getDiff(self):

return self.__diff

def onEnterCanceled(self, position):

self.__position = None

def onEnterOk(self, position):

execInfo = position.getEntryOrder().getExecutionInfo()

self.info("BUY at $%.2f" % (execInfo.getPrice()))

def onExitOk(self, position):

execInfo = position.getExitOrder().getExecutionInfo()

self.info("SELL at $%.2f" % (execInfo.getPrice()))

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

account = self.getBroker().getCash()

bar = bars[self.__instrument]

if self.__position is None:

one = bar.getPrice() * 100

oneUnit = account // one

if oneUnit > 0 and self.__diff[-1] > self.__break:

self.__position = self.enterLong(self.__instrument, oneUnit * 100, True)

elif self.__diff[-1] < self.__withdown and not self.__position.exitActive():

self.__position.exitMarket()

def runStrategy():

# 下载数据

jdf = ts.get_k_data("000725")

# 新建Adj Close字段

jdf["Adj Close"] =jdf.close

# 将tushare下的数据的字段保存为pyalgotrade所要求的数据格式

jdf.columns = ["Date", "Open", "Close", "High", "Low", "Volume", "code", "Adj Close"]

# 将数据保存成本地csv文件

jdf.to_csv("jdf.csv", index=False)

feed = yahoofeed.Feed()

feed.addBarsFromCSV("jdf", "jdf.csv")

myStrategy = MyStrategy(feed, "jdf")

myStrategy.run()

print("Final portfolio value: $%.2f" % myStrategy.getResult())

runStrategy()

输出如下

2015-07-30 00:00:00 strategy [INFO] BUY at $3.78

2015-07-31 00:00:00 strategy [INFO] SELL at $3.57

2015-08-05 00:00:00 strategy [INFO] BUY at $3.73

2015-08-06 00:00:00 strategy [INFO] SELL at $3.56

...

2018-02-13 00:00:00 strategy [INFO] BUY at $5.45

Final portfolio value: $7877.30猛地一看会发现,用框架似乎写了更多的代码,但是框架内置了更多分析工具。

下面简单介绍。

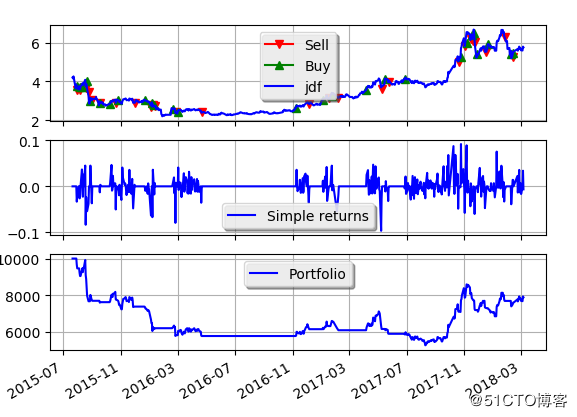

策略可视化

from pyalgotrade import strategy

from pyalgotrade import technical

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade import plotter

from pyalgotrade.stratanalyzer import returns

class DiffEventWindow(technical.EventWindow):

def __init__(self, period):

assert(period > 0)

super(DiffEventWindow, self).__init__(period)

self.__value = None

def onNewValue(self, dateTime, value):

super(DiffEventWindow, self).onNewValue(dateTime, value)

if self.windowFull():

lastValue = self.getValues()[0]

nowValue = self.getValues()[1]

self.__value = (nowValue - lastValue) / lastValue

def getValue(self):

return self.__value

class Diff(technical.EventBasedFilter):

def __init__(self, dataSeries, period, maxLen=None):

super(Diff, self).__init__(dataSeries, DiffEventWindow(period), maxLen)

class MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, diffPeriod=2):

super(MyStrategy, self).__init__(feed, 10000)

self.__instrument = instrument

self.__position = None

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__diff = Diff(self.__prices, diffPeriod)

self.__break = 0.03

self.__withdown = -0.03

def getDiff(self):

return self.__diff

def onEnterCanceled(self, position):

self.__position = None

def onEnterOk(self, position):

execInfo = position.getEntryOrder().getExecutionInfo()

self.info("BUY at $%.2f" % (execInfo.getPrice()))

def onExitOk(self, position):

execInfo = position.getExitOrder().getExecutionInfo()

self.info("SELL at $%.2f" % (execInfo.getPrice()))

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

account = self.getBroker().getCash()

bar = bars[self.__instrument]

if self.__position is None:

one = bar.getPrice() * 100

oneUnit = account // one

if oneUnit > 0 and self.__diff[-1] > self.__break:

self.__position = self.enterLong(self.__instrument, oneUnit * 100, True)

elif self.__diff[-1] < self.__withdown and not self.__position.exitActive():

self.__position.exitMarket()

def runStrategy():

# 下载数据

jdf = ts.get_k_data("000725")

# 新建Adj Close字段

jdf["Adj Close"] =jdf.close

# 将tushare下的数据的字段保存为pyalgotrade所要求的数据格式

jdf.columns = ["Date", "Open", "Close", "High", "Low", "Volume", "code", "Adj Close"]

# 将数据保存成本地csv文件

jdf.to_csv("jdf.csv", index=False)

feed = yahoofeed.Feed()

feed.addBarsFromCSV("jdf", "jdf.csv")

myStrategy = MyStrategy(feed, "jdf")

returnsAnalyzer = returns.Returns()

myStrategy.attachAnalyzer(returnsAnalyzer)

plt = plotter.StrategyPlotter(myStrategy)

plt.getInstrumentSubplot("jdf")

plt.getOrCreateSubplot("returns").addDataSeries("Simple returns", returnsAnalyzer.getReturns())

myStrategy.run()

print("Final portfolio value: $%.2f" % myStrategy.getResult())

plt.plot()

runStrategy()

图片输出如下

注: 这里的策略测试股票选择以及时间选择并不严谨,仅作功能展示,测试结果可能有很大的巧合性。Pyalgotrade详细介绍皆使用参考:http://gbeced.github.io/pyalgotrade/docs/v0.18/html/index.html

上述源代码:https://github.com/youerning/blog/blob/master/python-trade/demo.py

股价监控

根据这个需求写了一个股价监控的半成品,通过邮箱监控。

项目参考: https://github.com/youerning/UserPyScript/tree/master/monitor

技巧:在微信的辅助功能里面启用QQ邮箱提醒的功能,那么股价变动的通知就会很及时了,因为微信几乎等同于短信了。

这里简单说一下各个配置项及使用方法。

default段落

breakthrough代表突破的比例,需要传入两个值,项目里面的突破比例依次是3%,5%.

withdraw代表回撤,也需要两个值,示例为3%,5%.

attention代表关注的股票列表,填入关注的股票代码,用空格隔开

注:这里暂时没有考虑关注股票的情况,所以很多的关注股票也许有性能上的问题。

mail段落

依次输入用户名及密码以及收件人的邮箱

position段落

当前持仓的股票以及其持仓成本。

如持有京东方A(000725)以5.76的股价。

000725 = 5.76

如果多个持仓就多个如上的相应的键值对。

使用方法参考该脚本的readme

https://github.com/youerning/UserPyScript/blob/master/monitor/README.md

==PS:很难过的是英文水平不好还用因为注释,以及用英文词汇做变量名,如果词不达意请见谅。==

下单

这一部分本人暂时没有让程序自动执行,因为暂时还没有打磨出来一套适合自己并相信的体系,所以依靠股价监控的通知,根据不断修正的体系在手动执行交易。

后记

由于入市不到一年,所以就不用问我走势或者收益了, 当前战绩是5局3胜,微薄盈利。

最后以下图结束.

最后的最后:

关注一下再走呗^_^

上一篇: python3 获取阿里云OSS 最新存

下一篇: python3 requests请求re

- openvpn linux客户端使用

52052

- H3C基本命令大全

51919

- openvpn windows客户端使用

42147

- H3C IRF原理及 配置

38994

- Python exit()函数

33493

- openvpn mac客户端使用

30443

- python全系列官方中文文档

29080

- python 获取网卡实时流量

24109

- 1.常用turtle功能函数

24017

- python 获取Linux和Windows硬件信息

22366

- LangChain1.0-Agent-部署/上线(开发人员必备)

114°

- LangChain1.0-Agent-Spider实战(爬虫函数替代API接口)

150°

- LangChain1.0-Agent(进阶)本地模型+Playwright实现网页自动化操作

163°

- LangChain1.0-Agent记忆管理

148°

- LangChain1.0-Agent接入自定义工具与React循环

173°

- LangChain1.0-Agent开发流程

161°

- LangChain1.0调用vllm本地部署qwen模型

177°

- LangChain-1.0入门实践-搭建流式响应的多轮问答机器人

185°

- LangChain-1.0入门实战-1

185°

- LangChain-1.0教程-(介绍,模型接入)

195°

- 姓名:Run

- 职业:谜

- 邮箱:383697894@qq.com

- 定位:上海 · 松江